I was reading a post the other day advising AWS customers to consider why they aren’t reaching 100% RI coverage. This triggered me, as 100% coverage is often not a good thing. And yes, now we have Savings Plans for Some Things in AWS, but some places remain with Reservations as the way to get consumption discounts by trading on flexibility.

And it’s that trade on flexibility that is critical.

1 year versus 3 years

First off, 3 years versus 1 year; the difference in percentage discount is often negligible, sometimes as low as 1% – 2%. Whereas, over the difference (years 2 and 3), there is the distinct possibility that a new instance type may come out, offering better power, performance, or price. That price improvement point has historically been seen as around 15%, which makes for an ideal time to “roll forward”, if you can. Reservations don’t technically STOP you from doing this, but if you’re not using the capacity you reserved then you may find your still paying for what you no longer use.

Rolling forward on services like RDS is not a problem; as the customer, you’re not managing the OS in the Virtual Machine or Container that its running in.

But in the EC2 world, you may find that your Linux or Windows OS needs an update to support the newer instance family. This was the case ones with RedHat 7.x and the change from m3 to m4; an updated Linux kernel was required. You were fortunate if you were on RedHat Enterprise Linux >=7, as this was when in-place upgrades were introduced — not that this is the recommended DevOps path (rip and replace the instance is my preference).

In-place upgrades made this something that could get you out of a lot of re-engineering if a workload was not already designed with rolling updates and instance replacement in mind. Revolutionary as this was for Redhat 7 GA in 2014, but (as a Debian Developer) Debian’s been doing that since 1996.

Reservations in Waves

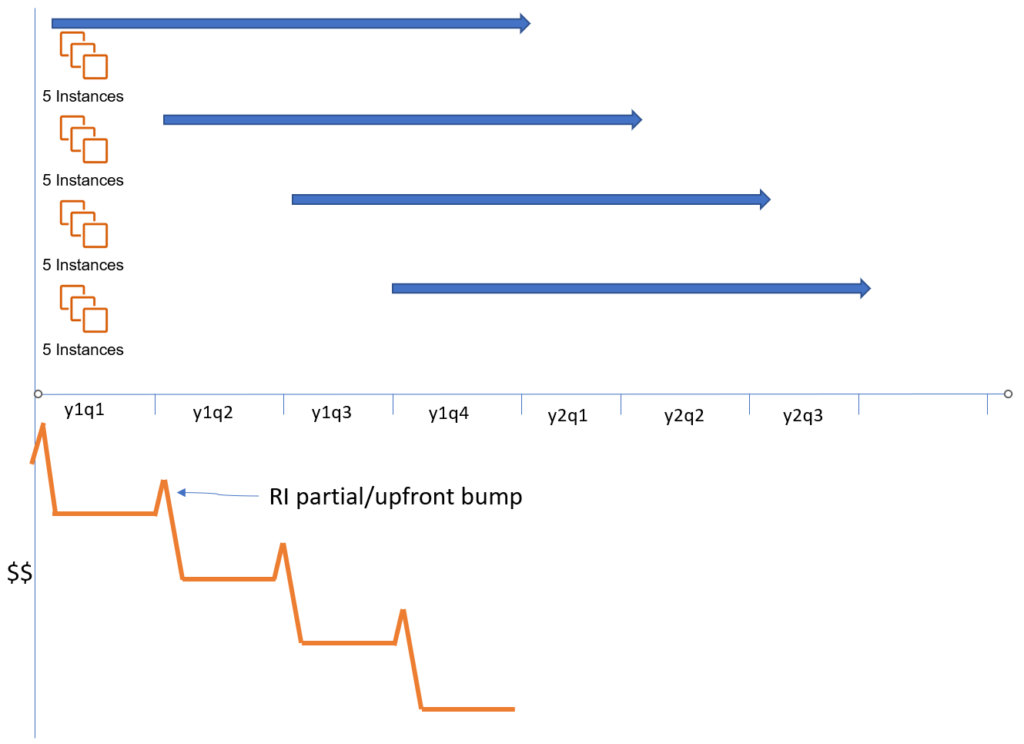

The next thing to look at is slicing your reservations into waves, to give you future flexibility.

Typically a partial or full up front payment for your reservation is going to give you the biggest discount, but at the cost of hitting your cash flow now. If you had 20 Reservations required, then you’d be tempted to acquire all of them immediately.

But wait, what happens if you change your mind for some of that workload now, or in 3 months time. And sinking all that capital now may be undesirable.

I’d strongly suggest slicing this into quarterly reservations (each at one year’s duration, as above), picking up (at most) a quarter of your fleet each time. This will, in future, give you a quarterly opportunity to adjust your coverage mix.

And while I say at most a quarter of the fleet; you may still want some flexibility to scale down a little, so perhaps your target is not continual 100% coverage, but continual 80% coverage.

This discussion is then a risk conversation, of making commitments you may want to adjust. And knowing the way you may want to adjust is something that is learnt through experience.

At each quarter, there is a smaller bump for the upfront or partial up front payment, but each of those bumps is now (and in future) a decision point.

This financial operating model may not fit your risk/reward requirements, but its worth considering your approach to long term discounts, and the flexibility you may want in future.